DeacWatcher

Ricky Peral

Suckers

Truly suckers of the highest order. His ancestors probably bought the secret concoction that cured all diseases from those circus barkers that roamed the old west back in the day.

Suckers

https://www.wsj.com/articles/whirlp...-for-a-trade-war-1531757621?mod=hp_lista_pos2

CLYDE, Ohio—After the Trump administration announced new tariffs on imported washing machines in January, Marc Bitzer, the chief executive of Whirlpool Corp., celebrated his win over South Korean competitors LG Electronics Inc. 066570 3.14% and Samsung Electronics Co.

“This is, without any doubt, a positive catalyst for Whirlpool,” he said on an investor conference call.

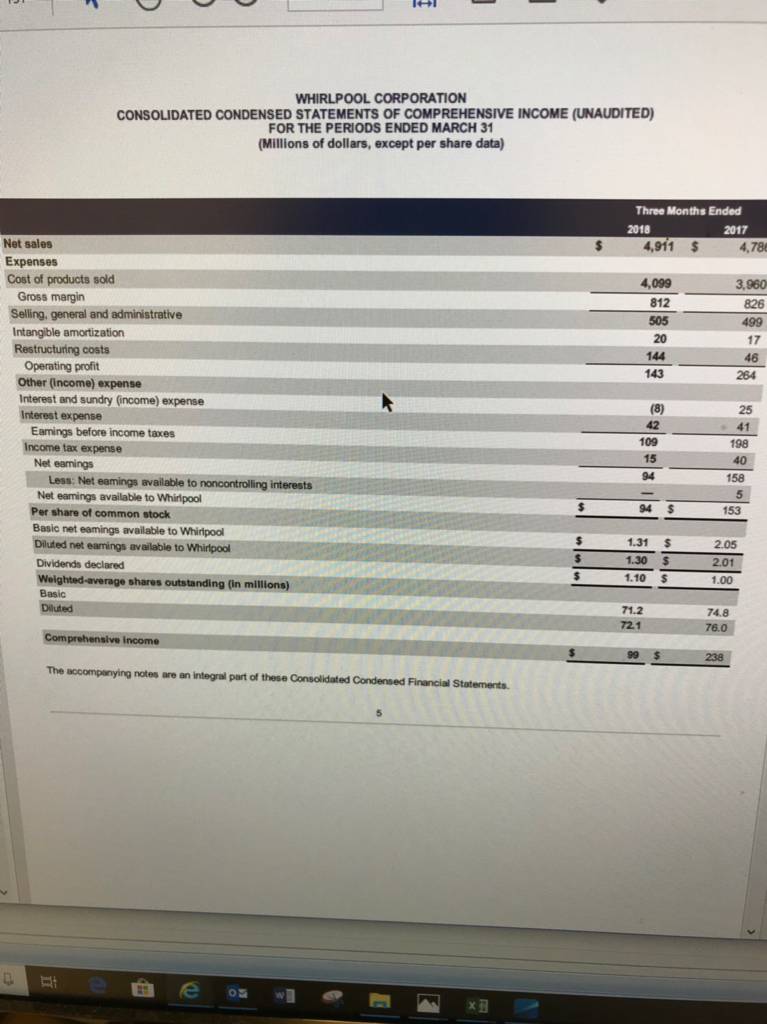

Nearly six months later, the company’s share price is down 15%. One factor is a separate set of tariffs on steel and aluminum, imposed by the U.S. in March and later expanded, that helped drive up Whirlpool’s raw-materials costs. Net income, even with the added benefit of a lower tax bill, was down $64 million in the first quarter compared with a year earlier.

In his next call with investors, in April, Mr. Bitzer struck a cautious tone. “There continues to be uncertainty regarding potential future tariffs and trade actions,” he said. “We’ll continue to monitor, evaluate and take the right action for our business.”

Whirlpool had campaigned for protection from what it called unfair foreign competition. Things became more complicated as the trade conflict spread beyond its industry.

“Raw-material costs have risen substantially,” Mr. Bitzer said on the April investor call, primarily blaming steel and aluminum tariffs. Most of the 200-pound weight of a washing machine is in its steel and aluminum parts.

you know that stock prices are forward looking? I agree that it wasn't the catalyst of 1st quarter earnings decline although gross margin did decrease on increased volume.