dartsndeacs

THE quintessential dwarf

is the $90K at 12% for married couples or single filers?

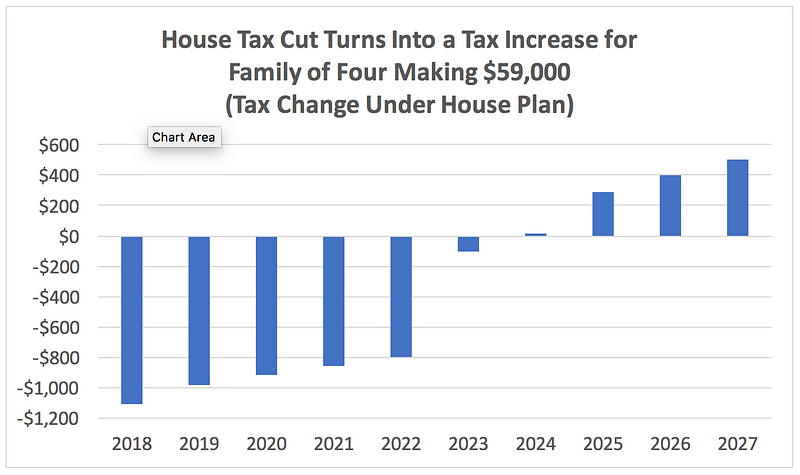

Married, so you'd assume 45k for single. So in simple terms, all single people save $1,500 for the first $45k of their income + another $400 for the slightly higher standard deduction, so $1,900 overall. Double that if married for about $3,800. You lose about $400 per kid, if you have children.

Wow, for single its 12% up to $67,500. That's huge. About $5,000 less in taxes paid per person.

Last edited: