Deacfreak07

Ain't played nobody, PAWL!

So now there will potentially be spending cut triggers if the magic boom of economic growth from these tax cuts doesn't manifest? Awesome!

So now there will potentially be spending cut triggers if the magic boom of economic growth from these tax cuts doesn't manifest? Awesome!

So if the wealthiest Americans don't generate economic growth with the tax cuts, what spending gets cut?

So if the wealthiest Americans don't generate economic growth with the tax cuts, what spending gets cut?

There is no economic theory that justifies the tax bill currently moving through the Senate, not even the “trumped-up trickle-down” kind.

America’s top conservative economists have tacitly admitted as much. Earlier this week, Robert Barro, Glenn Hubbard, Michael Boskin, and six other economists wrote a letter to Steve Mnuchin, informing the Treasury secretary that the GOP’s tax-reform plan would accelerate economic growth by spurring investment. But in order to reach this conclusion, these right-wing wonks didn’t merely rely on a discredited economic theory — they also posited a wholly fictional Republican tax plan.

The baby boom is being evicted from the penthouse of American politics. And on the way out, it has decided to trash the place.

That’s probably the best way to understand the generational implications of the tax legislation Republicans are driving through Congress.

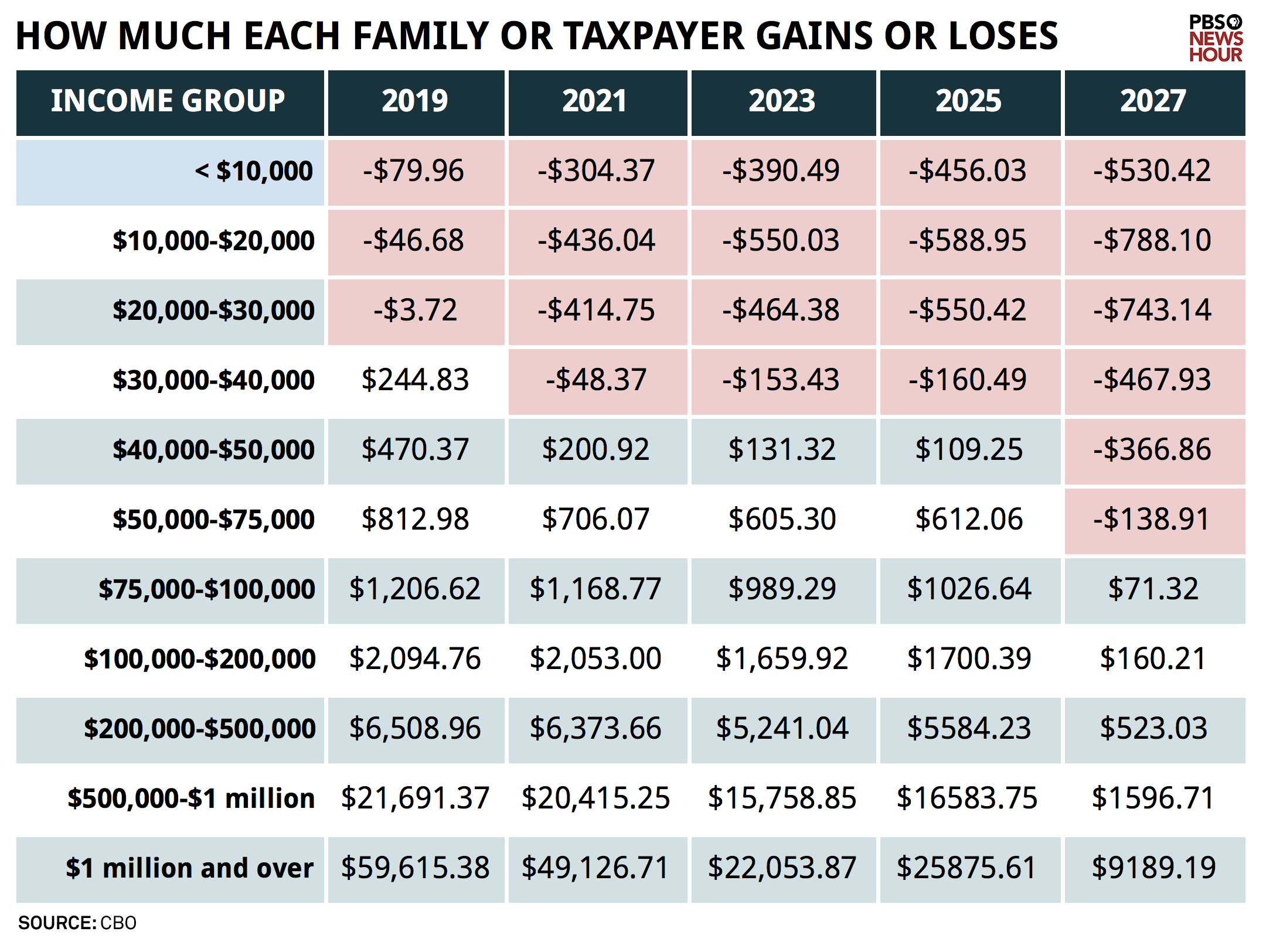

The House and Senate measures shower enormous benefits on households at the top of the economic ladder, a group that by all indications is older and whiter than the population overall. Then it hands the bill for those benefits largely to younger generations, who will pay through more federal debt; less spending on programs that could benefit them; and, eventually, higher taxes.

But the idea is opposed by many economists, who say it could force Congress to raise taxes in the middle of an economic slowdown — which they say is exactly the wrong time to do so.

"I'm concerned that if we hit a downturn, then we could have these automatic tax increases, and that would actually make a recession worse," said Gus Faucher, chief economist at PNC Financial Services Group.

So this thing is going to happen.

Was anyone truly of the belief that it wasn't? This and infrastructure spending were two things where there was literally nothing in the way from day 1.

I had some hope given these bills seem even worse than I expected.

No real surprise. The GOP is literally desperate to pass something, anything this year and get it on Trump's desk for approval just so they can say they passed some legislation. Judging from articles I've read, they're terrified that if they go into 2018 with no legislative accomplishments they'll be hammered in the 2018 elections. So, they're going to pass this, no matter how awful or financially unsound it is. Their problem, I think, is they don't seem to realize that passing an extremely unpopular bill (polls show that large majorities of Americans don't want it) may be just as damaging to their chances in 2018 as passing nothing. Of course, much of that depends on the Democrats getting their crap together and being able to effectively publicize and use the tax cut's unpopularity to their advantage next year. Given their performance in elections since 2010 (other than Obama's 2012 campaign, of course), I'm not counting on anything.

plama is absolutely right that the short term benefits will be very popular.