You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Non-Political - Officially NOT a recession thread

- Thread starter Colonel Angus

- Start date

- Latest activity Latest activity:

ImTheCaptain

I disagree with you

You can't imagine the problems when a few people are allowed to hoard resources?

the conservative dream

Colonel Angus

Well-known member

- Joined

- Apr 24, 2011

- Messages

- 3,712

- Reaction score

- 549

You can't imagine the problems when a few people are allowed to hoard resources?

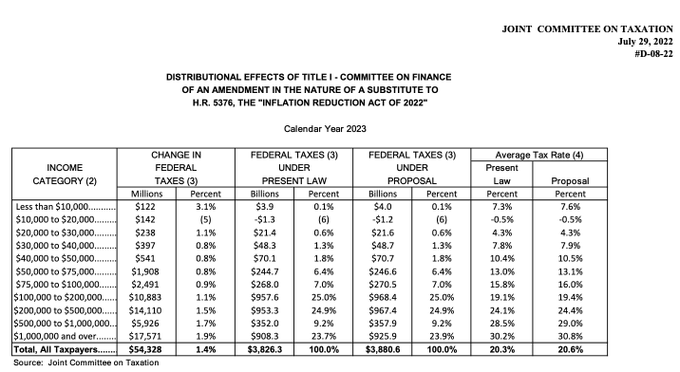

Which is why it's a great thing the 'Inflation Reduction Act' is increasing federal taxes by close to $17B for those earning less than $200k:

Sticking those hoarders earning less than $75k with a $3.3B higher annual tax bill will teach those fucks not to hoard resources from our democracy!!

Colonel Angus

Well-known member

- Joined

- Apr 24, 2011

- Messages

- 3,712

- Reaction score

- 549

Thanks for the shout out, Darlene. But the Joint Committee on Taxation is a nonpartisan committee.

Colonel Angus

Well-known member

- Joined

- Apr 24, 2011

- Messages

- 3,712

- Reaction score

- 549

The adults are finally back in charge - Decreasing average after-tax income at almost every income level is a great way to make life more affordable during a period of "global inflation" and "officially not a recession"

BarcaDeac

Well-known member

Thanks for the shout out, Darlene. But the Joint Committee on Taxation is a nonpartisan committee.

Hmm, let's see who the members are, let me check this .Gov website. Oh look, all politicians:

https://www.jct.gov/about-us/committee-members/

dartsndeacs

THE quintessential dwarf

The adults are finally back in charge - Decreasing average after-tax income at almost every income level is a great way to make life more affordable during a period of "global inflation" and "officially not a recession"

That 13.1% average tax rate instead of 13.0% is really gonna sting for those folks in the $50,000-$75,000 range.

Louis Gossett Jr

Well-known member

- Joined

- Sep 4, 2012

- Messages

- 12,718

- Reaction score

- 6,532

Didn’t really feel like finding this because it’s this dumb as shit troll and this isn’t a really discussion but pretty sure after reading this about how it’s a suspect model that isn’t showing tax increase but supposed reduced wages and jobs from corporations paying more tax passed onto workers but as usual the point still stands

https://nymag.com/intelligencer/202...00000-campaign-promise-corporations-rich.html

https://nymag.com/intelligencer/202...00000-campaign-promise-corporations-rich.html

Colonel Angus

Well-known member

- Joined

- Apr 24, 2011

- Messages

- 3,712

- Reaction score

- 549

I am not seeing any direct taxes that would affect taxpayers in income brackets that low. Must be some sort of estimated pushdown of corporate tax increases?

Wow - We are truly fucked if proud liberal tax accountants in Greensboro can't solve this puzzle

Colonel Angus

Well-known member

- Joined

- Apr 24, 2011

- Messages

- 3,712

- Reaction score

- 549

he wears his ignorance like a badge of honor

This is rich coming from Goebbels

Colonel Angus

Well-known member

- Joined

- Apr 24, 2011

- Messages

- 3,712

- Reaction score

- 549

I am not seeing any direct taxes that would affect taxpayers in income brackets that low. Must be some sort of estimated pushdown of corporate tax increases?

Any update yet, Chris?? Please have your team of part time tax accountants earning six figures do a deep dive on the bullshit numbers reported by the JCT and let us know.

Joe Biden told us that nobody making under $400k would see a tax increase. And if history is any indication, Joe Biden's word is gold.

dartsndeacs

THE quintessential dwarf

Any update yet, Chris?? Please have your team of part time tax accountants earning six figures do a deep dive on the bullshit numbers reported by the JCT and let us know.

Joe Biden told us that nobody making under $400k would see a tax increase. And if history is any indication, Joe Biden's word is gold.

or you could just google and read the first article that comes up

While the IRA proposes reforming the tax treatment of carried interest and Superfund cleanup fees, its primary tax increase is a 15 percent minimum tax on corporations’ “book” profits above $1 billion. Economists have long debated the precise portion of corporate taxes that end up falling on workers, as opposed to shareholders and other capital owners. JCT allocates the corporate tax 25 percent to labor and 75 percent to capital.

The labor portion in JCT’s model is relatively small compared to the burden faced by shareholders. But it’s enough to make the JCT distributional tables reflect tax increases among nearly all income groups in a bill where a corporate tax increase is the primary revenue source.

dartsndeacs

THE quintessential dwarf

They teach ya how to do that once ya become a six figure part-time accountant

https://www.taxpolicycenter.org/taxvox/putting-jcts-score-inflation-reduction-act-context

https://www.taxpolicycenter.org/taxvox/putting-jcts-score-inflation-reduction-act-context

deacdiggler

"Well known member"

- Joined

- Mar 28, 2011

- Messages

- 23,918

- Reaction score

- 11,962

there is nothing in this bill that would impact most middle class families other than possible trickle down impacts from the corporations.

note that the 1% excise tax on stock buybacks could apply to middle class families who are heavily invested in stocks. This was added to the bill by Republicans and Sinema to protect the carried interest carveout.

note that the 1% excise tax on stock buybacks could apply to middle class families who are heavily invested in stocks. This was added to the bill by Republicans and Sinema to protect the carried interest carveout.