You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Airline Rewards Credit Cards

- Thread starter awakeandready

- Start date

- Latest activity Latest activity:

dartsndeacs

THE quintessential dwarf

Not even close.

Why not? You're getting 1% on a ton of shit you're putting on a chase card

Sent from my iPhone using Tapatalk

dartsndeacs

THE quintessential dwarf

Sent from my iPhone using Tapatalk

dartsndeacs

THE quintessential dwarf

I suppose, from research, if you're exclusively playing the transfer the points for free trips to Europe/Hawaii/Asia game its worth it. But I'm guessing 90% of Chase people aren't doing this and could be better off with barclay

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

TuffaloDeac10

🌹☭

I suppose, from research, if you're exclusively playing the transfer the points for free trips to Europe/Hawaii/Asia game its worth it. But I'm guessing 90% of Chase people aren't doing this and could be better off with barclay

Sent from my iPhone using Tapatalk

Transferring Chase points to United to fly Lufthansa is the only way to go. Anything else is dumb.

tiltdeac

Well-known member

- Joined

- Mar 23, 2011

- Messages

- 4,496

- Reaction score

- 967

I suppose, from research, if you're exclusively playing the transfer the points for free trips to Europe/Hawaii/Asia game its worth it. But I'm guessing 90% of Chase people aren't doing this and could be better off with barclay

Sent from my iPhone using Tapatalk

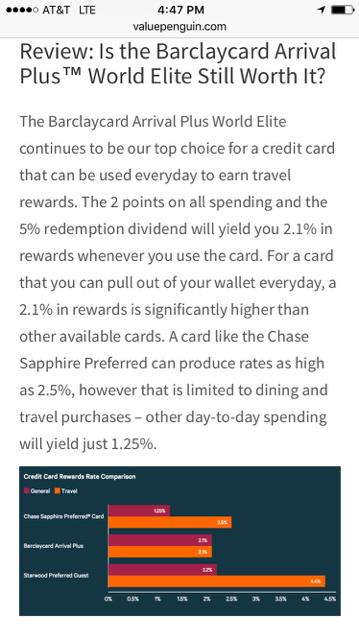

I mean sure, if you don't use the Chase cards correctly, it could be worse. And I'm sure a lot of people don't. But it's really simple to do WAY better than the Barclaycard with Chase, and I'm not getting 1% on anything. I use 3 chase cards for all my purchases. I use the Chase Freedom (no fee) for only the rotating categories every quarter (currently groceries and drug stores) that give 5% Chase Rewards. I use the Sapphire Reserve (net $150 fee) for all restaurants and travel purchases, which gives 3%, and the Freedom Unlimited (no fee) which gives a flat 1.5% for all other purchases.

But the key is that by having the Sapphire Reserve, those Chase points are worth an absolute minimum of 1.5 cent/point (through the travel portal), or significantly higher if you transfer them to travel partners (thepointsguy estimates they are worth 2.1 cents/point on average). So using the absolute floor value, I'm getting an effective 7.5% on groceries and drug stores, 4.5% on restaurants and travel, and 2.25% on all other purchases. That is compared the Barclaycard which has an effective reward of 2.1% on all purchases. And that doesn't take into account the massive sign up bonus (currently worth a minimum of $750 for the Reserve).

dartsndeacs

THE quintessential dwarf

That looks correct. Combined with about 30 mins of research, looks like the way to go. Thanks.

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

dartsndeacs

THE quintessential dwarf

Which cards are best for redeeming against Uber fees?

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

dartsndeacs

THE quintessential dwarf

And anyone have a good recommendation for a business where the goal is to get the 2 owners the most benefits?

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

TuffaloDeac10

🌹☭

Which cards are best for redeeming against Uber fees?

Sent from my iPhone using Tapatalk

I think Chase counts Uber as travel and 2x pts

dartsndeacs

THE quintessential dwarf

I think Chase counts Uber as travel and 2x pts

The reserve being 3x?

Sent from my iPhone using Tapatalk

DistrictDeacon

Well-known member

- Joined

- Mar 18, 2011

- Messages

- 13,054

- Reaction score

- 1,068

Transferring Chase points to United to fly Lufthansa is the only way to go. Anything else is dumb.

Meh. LH business is not worth the miles premium that United charges over its own business tickets.

And economy is economy.

The reserve being 3x?

Sent from my iPhone using Tapatalk

Yep. I use it a lot and it's always coded as travel regardless of country and the Uber affiliate that is listed on the statement.

Sent from my iPhone using Tapatalk

dartsndeacs

THE quintessential dwarf

Meh. LH business is not worth the miles premium that United charges over its own business tickets.

And economy is economy.

Well thats the kicker. You get 1.5x points redeeming through their portal, but how does their portal compare to Expedia?

Sent from my iPhone using Tapatalk

WFU Lurker

Well-known member

- Joined

- Jan 22, 2014

- Messages

- 2,621

- Reaction score

- 185

Well thats the kicker. You get 1.5x points redeeming through their portal, but how does their portal compare to Expedia?

Sent from my iPhone using Tapatalk

I think Expedia actually runs the portal...

JuiceCrewAllStar

Whole Milk Drinker

- Joined

- Feb 4, 2014

- Messages

- 37,061

- Reaction score

- 9,786

Well thats the kicker. You get 1.5x points redeeming through their portal, but how does their portal compare to Expedia?

Or you can transfer directly to partner airlines and book through their website. You can get some killer fares that way.

WFU Lurker

Well-known member

- Joined

- Jan 22, 2014

- Messages

- 2,621

- Reaction score

- 185

They do fine on the routine things, although not as well as the Sapphire folks do, who pick up on the first ring (no menus, no hold time) and are always 100 percent understandable (not to be an OWG...).

But that just means they have adequate staffing and baseline training. Whoopie.

When it comes to the extreme situation, or at least my extreme situation, they have been awful. Customer service told me false information (do not assume that a corporate card has rental car coverage and do not assume that customer service is qualified to tell you if it does or not), but has shown no willingness to go to bat for me. Meanwhile, the rental claims group is either lying to me or, at this point, willfully ignoring what I am saying and, in the process, implying that I am lying and that I doctored phone records. Seriously, their assertion is that I have never called customer service throughout this ordeal! Thank god that I didn't really damage that rental car and Hertz just stuck me with a bill for absolutely unnoticeable damage that was there when I picked up the car, otherwise I might be out 20k, instead of just 2k (Hertz is also on my naughty list).

So I don't care about benchmarking surveys. In customer service, anecdotes are actually really important because they show what happens when people are pushed outside of the protocol. Amex has failed miserably, and I will tell everyone who will listen about it.

For those curious, my last ditch effort failed despite being told by three different agents that call validation confirmed what I said and actually being told twice that the money would be credited to my account within 48 hours. Apparently those agents just didn't read the notes properly. Good bye $2000. Good bye Amex.

Long story short, they only record random calls. Since they didn't happen to record the original call where I received wrong information, I am on the hook for their mistake. Though the last rep I talked to said that it might not have even mattered, since my company is the authority on the card's benefits, not Amex. I lit into her more than I probably should have for that one.

Needless to say, I immediately canceled my SPG Amex, and I will not being using the Corporate card any longer. At one point I was probably spending 5000 to 7000 a month between my SPG and Corporate Amexes. Less lately since I switched business food expenses to my Sapphire, but, regardless, clearly they never ran any kind of lifetime customer value analysis on this one.

Hard to say if Chase would have performed better and hopefully will never find out, but I know for a fact Amex handled the whole situation about as poorly as possible.

Bubble Boy

Well-known member

- Joined

- Mar 29, 2011

- Messages

- 4,808

- Reaction score

- 448

Check your own auto policy. I think mine has standard coverage for rental cars.

If you have property coverage (comp/collision) on your auto policy, then it should cover damage to a rental. You will have to cover your deductible, and it likely won't cover any sort of trumped up "loss of use" charge the rental company may throw at you, but it should cover the basic damage to the car.

WFU Lurker

Well-known member

- Joined

- Jan 22, 2014

- Messages

- 2,621

- Reaction score

- 185

If you have property coverage (comp/collision) on your auto policy, then it should cover damage to a rental. You will have to cover your deductible, and it likely won't cover any sort of trumped up "loss of use" charge the rental company may throw at you, but it should cover the basic damage to the car.

Yeah, I don't have comprehensive coverage. Not worth it since my car is worth virtually nothing.

Oh well, lesson learned.