buckets

#1 Bald Hero

- Joined

- Mar 28, 2011

- Messages

- 38,914

- Reaction score

- 4,701

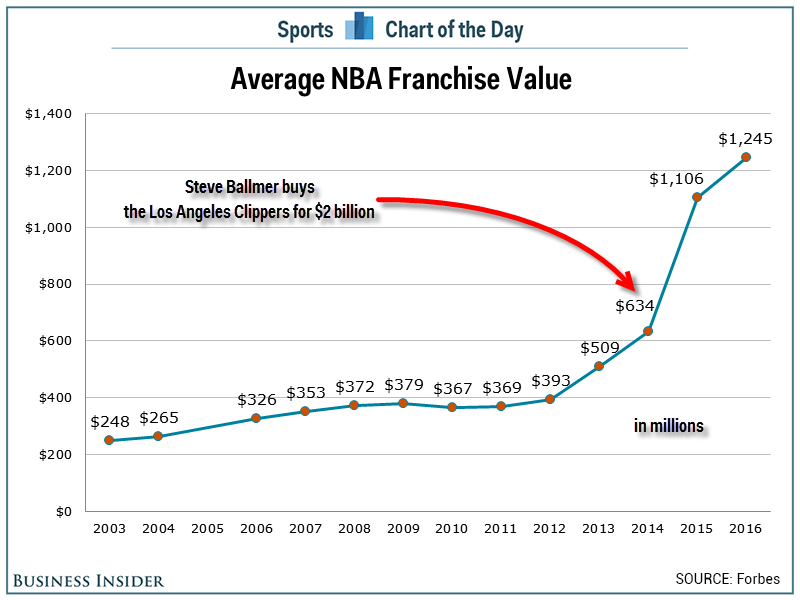

Clips are a bad example / outlierMost everything is valued at a cap rate. NBA franchises have a low one because of the prestige/scarcity. Everything's valued the same way, but cap rate is used in the real estate realm (where I live). In stocks its called multiples. You can invert a 5% cap rate and say its selling at 20x earnings. Same shit.

the Clippers are worth as much as the Red Sox based on that CBA. Before it they were worth like $500 mil. That's absurd.