You Cannot Be Too Cynical About the Republican Tax Bill

If you can read via the link there are many links embedded in the article.

Quote

—————

The rush to enact the tax bill was designed to mask — as a break for the middle class — what is in fact a $1.4 trillion package of benefits for key donors and lobbyists, the richest members of Congress, President Trump, his family and other families like his.

The speed from introduction to passage — seven weeks, with no substantive hearings — effectively precluded expert examination of the legislation’s regressive core, its special interest provisions and the long-term penalties it imposes on the working poor and middle class through the use of an alternative measure of inflation — the “chained CPI.”

Only last Friday, when the legislation came out of conference committee and was no longer subject to amendment — and when decisive majorities of House and Senate Republicans had publicly committed to vote for the legislation — did experts and journalists begin to fully catch up with its defects.

Two days before Congress gave final approval, a group of 13 tax law experts released the most incisive critique of the tax bill to date, a 30-page document called “The Games They Will Play: An Update on the Conference Committee Tax Bill.”

The primary authors of the report — Ari Glogower, David Kamin, Rebecca Kysar, and Darien Shanske — describe the legislation as “a substantial blow to the basic integrity of the income tax” that will “advantage the well-advised in ways that are both deliberate and inadvertent.”

The authors cite a wide range of specific flaws, but their main argument is that the measure is gravely deficient at its core:

The most serious structural problems with the bill are unavoidable outcomes of Congress’s choice to preference certain taxpayers and activities while disfavoring others — and for no discernible policy rationale. These haphazard lines are fundamentally unfair and inefficient, and invite tax planning by sophisticated taxpayers to get within the preferred categories.

Glogower, Kamin, Kysar, and Shanske argue that some of the most egregious loopholes and schemes permitted by the legislation are that individual taxpayers

will be able to shield their labor income from tax by simply setting up a corporation and having their income accrue in the form of corporate profits. As a result, income that would have been taxed at the high individual rates is instead taxed at the low corporate rate.

Second, the legislation creates a huge incentive for anyone in a position to do so to change his or her status from employee to “independent contractor or a partner in a firm. The game is clear: Don’t be an employee, instead be an independent contractor or partner in a firm.” The ability to make this shift is available primarily to the well-paid.

The legislation, according to Glogower and his colleagues, also fails to present a coherent rationale:

the fundamental problem is the lack of any underlying logic in deciding who benefits from the pass-through deductions, and who does not. Independent contractors and partners benefit, but not employees. Why? An owner of real estate through a REIT benefits, but not the doctor in the building. Why? An architect benefits in some ways that a lawyer does not. And so on.

The bill encourages tax evasion. Glogower and his colleagues cite

opportunities to use rate differentials and ill-considered transitions to engage in transactions that serve to basically pump money out of the Treasury and into the pockets of well-advised taxpayers.

To provide an example, they use a company that purchased equipment under existing law, which provides them with tax breaks on the cost spread out over the years in a depreciation schedule. The new law allows companies to immediately write off the full cost of buying equipment, known as expensing.

“So,” the authors ask, “what does that mean?”

It means that old property can still get the benefit of expensing, but only if it is sold to another party. If the original owner holds it, they have to depreciate according to the old rules; if they sell it to another party, then suddenly the full cost is eligible for expensing, and the net effect is an immediate deduction of the existing tax basis of the asset. The parties can split the resulting surplus. It appears that the buyer of the asset could even lease it back to the existing owner, so that the property doesn’t even have to go anywhere.

I emailed some of the authors of this report for their individual thoughts.

Michael Kane, a law professor at N.Y.U., wrote in response that the bill will

create new incentives to shift tangible assets (and jobs) abroad. Given President Trump’s relentless message about U.S. jobs, it is incomprehensible to me that we are about to pass something that has this effect without any kind of meaningful discussion of the issue.

Daniel Hemel, a law professor at the University of Chicago, raised a crucial question about the long-term effects of the legislation’s adoption of chained CPI, a method of calculating the rate of inflation for the earned-income tax credit and other sections of the tax code that provide breaks to working- and middle-class families.

He noted that

lower and middle-income families, who are especially dependent upon inflation-indexed deductions, credits, and bracket thresholds, will feel the impact increasingly as time goes on.

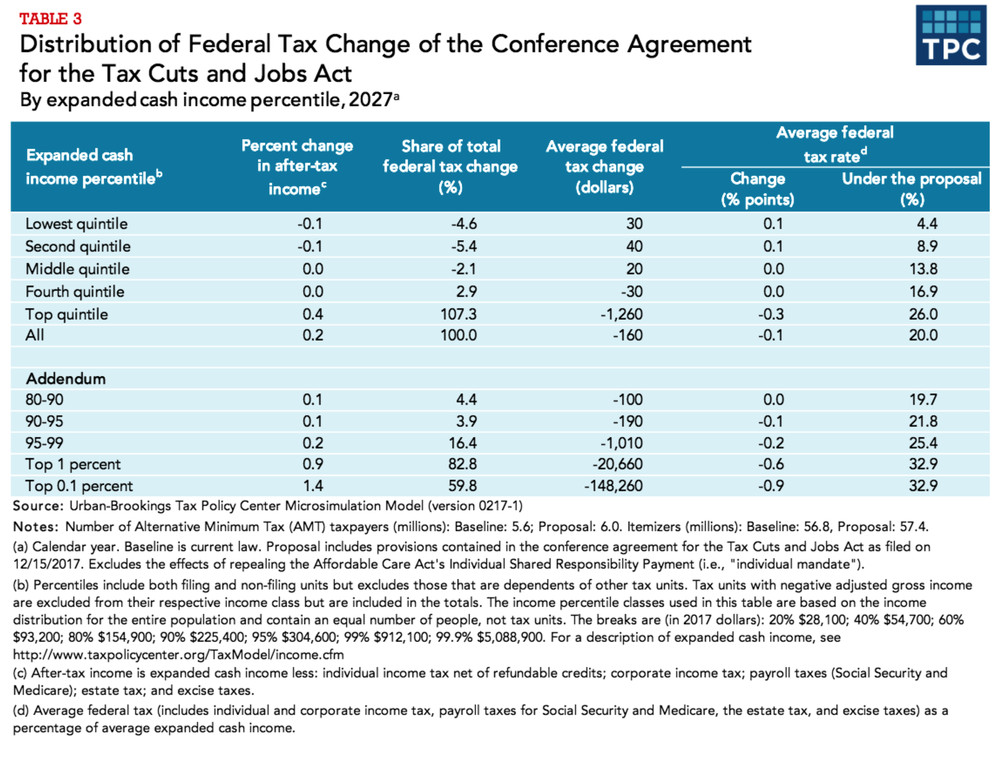

In the first year, 2018, the changed inflation rate raises a relatively modest $31.5 billion but it grows every year, reaching $37 billion in 2027. “To be sure,” Hemel wrote, “this affects everyone to some degree, but most of the burden is paid for by families in the bottom four quintiles.”

In the long term, Hemel argued,

this is a very subtle way to increase taxes on the lower and middle classes and then use those revenues to pay for a massive tax cut for corporations.

What may prove even more significant is the shift to chained CPI — a less generous, slower-growing measure of inflation than the one currently in use that would result in a tax increase over time and sets a precedent for Republicans who would like to use the same method to pare back so-called entitlement programs like Social Security and Medicare. It is, in effect, a backdoor method of reducing benefits for the elderly and the disadvantaged without public scrutiny or debate.

This full-speed-ahead strategy simultaneously constrained the ability of the press to explore the special interest provisions buried in the legislation.

One exception is the work of three reporters from International Business Times — Alex Kotch, David Sirota and Josh Keefe — who have pursued this line of inquiry for the past week. A recent story disclosed that a provision inserted at the last minute into the bill stands to lower taxes on the income of 14 Republican Senators.

Along parallel lines, a liberal think tank, the Center for American Progress, now estimates that Senator Ron Johnson, Republican of Wisconsin, will get an annual tax break of somewhere between $21,500 and $205,000 based on his 2016 financial disclosure statement. The center’s calculations are based on Johnson’s reported income from three holdings he said produced a minimum of $215,002 up to a maximum of $2,050,000.

And the 2016 financial disclosure statement filed by Senator Steve Daines, Republican of Montana, shows income from real estate holdings of $487,500 to $4,305,000. If Daines’ tax cut is computed using the same method that the center used for Johnson, it would be between $47,582 and $430,500.

Not only are many senators direct beneficiaries of the legislation, but 15 of the top 20 Senate recipients of contributions from the real estate industry are Republicans, according to Open Secrets, ranging from Marco Rubio at $3.27 million to Chuck Grassley at $276,636.

Perhaps most important, the measure rewards those who need it least — the very wealthy — while leaving those most in need with modest and temporary tax breaks. The bill will diminish opportunities for social mobility by doubling the estate tax exemption, further entrenching generation after generation at the top of the income distribution.

As my colleague Jim Tankersley put it on Dec. 16, the final version of the legislation

offers little redress to workers who have grown to believe that the country’s tax law thicket advantages those with power, political connections and lawyers on retainer. Its evolution undermines a central selling point for a bill that is already seen by most Americans as unlikely to benefit them, according to polls.

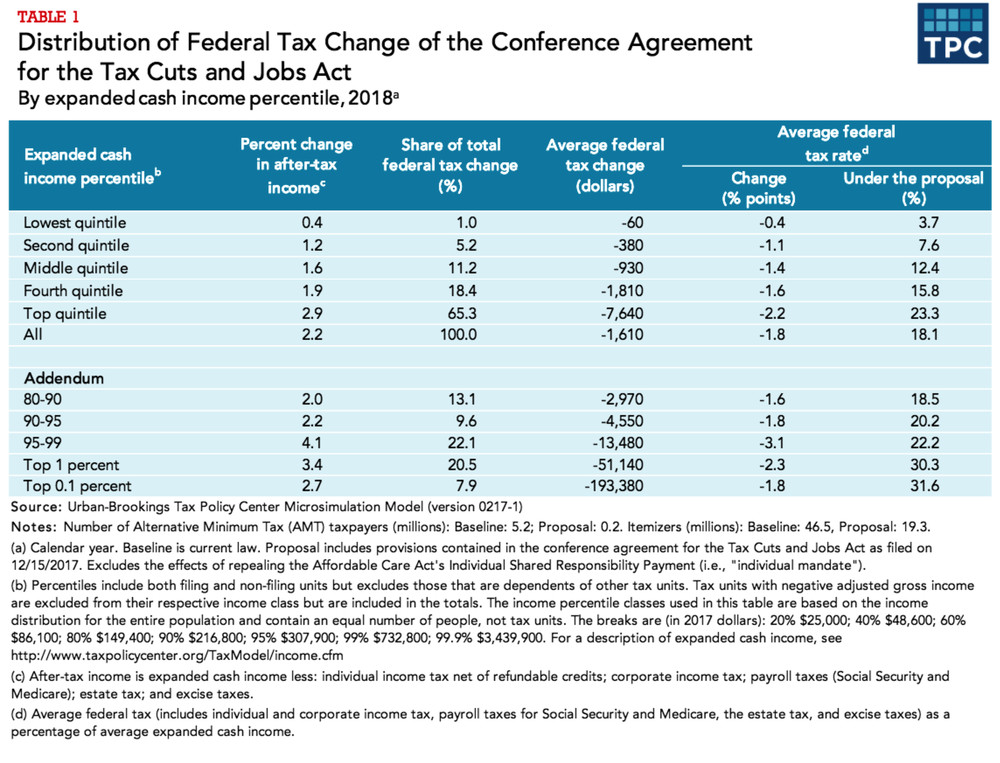

The accompanying chart produced by the nonpartisan Tax Policy Center describes the distribution of the benefits by income groups over the next decade.

[you will have to go to site to see the graphic]

Despite the fact that the measure is a tax cut, the majority of Americans, 53 percent, currently disapprove of the law and 35 percent approve, according to a CBS Poll. Most Americans believe the bill will help large corporations (76 percent) and the wealthy (69 percent), while 35 percent believe it will help the middle class and 24 percent said their own families will gain.

A tax expert who insisted on anonymity in order to protect client confidentiality, emailed me his critique of the bill:

(1) The corporate rate reduction is permanent, for individuals only temporary. Completely obnoxious. In effect the money “saved” within the 10 year budget window by making those individual cuts temporary helped to underwrite the cost of making the corporate/pass though side permanent

(2) Carried interest provision. When Trump was careening around in his populist candidate mode, he promised to end it. Here is one campaign promise that he “somehow” failed to redeem when the clear and available chance presented itself.

(3) Restriction on state and C local tax deduction — consciously vindictive imposition of double taxation on citizens of certain Democratic states; corporations and pass through businesses, the darlings of the Republicans, still get to deduct those very same taxes in full.

(4) Expanding the standard deduction but financing the cost of so doing by repealing the personal exemptions is a bit of a bait and switch maneuver. Some people might be worse off.

(5) In a bill in which 100s of billions of dollars were sloshing around to provide steep tax cuts for already wealthy and highly prosperous corporations and pass through businesses, the Republicans could only find the will to raise the refundable portion of the child care tax credit from $1000 to $1400. Rubio wanted it to be raised to $2000 and his Republican brethren refused to even meet him halfway. Pitiful.

(6) Deduction for extraordinary medical expenses — retention of this deduction did not even get the five-year sunset window applied to all the other individual tax provisions, two years only. Vicious.

(7) Pass through business taxation — the bill is a massive tax gift to some of the wealthiest people in the country, who are conducting business operations in non-corporate form or are investors in same.

The tax bill not only alters the competitive structure of American industry but includes such major provisions as opening the Arctic National Wildlife Refuge in Alaska to oil drilling and the elimination of mandatory individual health insurance under Obamacare.

What amounted to three major pieces of legislation were approved by the full House and the Senate Finance Committee, “two weeks after the bill was unveiled, without a single hearing on the 400-plus-page legislation,” as Thomas Kaplan and Alan Rappeport put it in The Times.

How well does this procedure stand up to the requirements Senator Ben Sasse specified in his maiden Senate speech on Nov. 3, 2015? In it, Sasse argued that the Senate was failing in its responsibility to fully air and debate the important issues before the county, calling for what he called “a cultural recovery inside the Senate”:

One of our jobs is to flesh out competing views with such seriousness and respect that we should be mitigating, not exacerbating, the polarization that does exist ...

Good teachers don’t shut down debate; they try to model Socratic seriousness by putting the best possible construction on arguments, even — and especially — if one doesn’t hold those positions.

Or, for that matter, how well does the bill fit with Senator John McCain’s determination to lay down the law on “regular order,” as outlined in an Aug. 31 op-ed in the Washington Post? “We are proving inadequate not only to our most difficult problems but also to routine duties,” McCain wrote. Or as McCain noted during the debate over legislation to repeal Obamacare, he was calling

for a return to regular order, letting committees of jurisdiction do the principal work of crafting legislation and letting the full Senate debate and amend their efforts. We won’t settle all our differences that way, but such an approach is more likely to make progress on the central problems confronting our constituents. We might not like the compromises regular order requires, but we can and must live with them if we are to find real and lasting solutions.

So far, however, only one Republican senator has suffered real costs for deciding to vote for the tax bill.

Just over two months ago, Bob Corker drew a line in the sand on the bill: if it raised the deficit, he would vote no:

No way that Bob Corker is going to vote for a tax reform bill that I think in any way is going to add to the deficit. It’s not going to happen, never. It’s never going to happen. Never, never, ever.

On Oct. 5, Susan Davis of National Public Radio put Corker on record with a series of quotes that he may have come to regret:

This is the most passionate thing for me, period, that I work on. Not foreign policy. Not banking. It’s this deficit issue.

For Corker, this issue went way beyond routine politics: “Deficits matter,” he forcefully asserted. “They are a greater threat to us than North Korea or ISIS.”

This past week Corker has decided that the deficit is no longer “the most passionate thing for me.” Instead, he voted for a tax bill that will increase the deficit by $1.46 trillion over ten years. In a statement, Corker declared:

In the end, after 11 years in the Senate, I know every bill we consider is imperfect and the question becomes is our country better off with or without this piece of legislation. I think we are better off with it.

All of this raises a basic question. How could nearly every Republican representative — and all 52 Republican senators — support the tax bill? The best answer may be the most cynical: because it benefits key leaders, their friends, their heirs and their donors.

After looking at the legislation in its entirety — its substance and the procedures used to get there — it is difficult to conclude that the motivations of its sponsors are either benevolent or somehow in the best interests of the country. More likely it is hypocrisy and venality mixed up into one awful bill.

—————