You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

income inequality debate

- Thread starter TownieDeac

- Start date

- Latest activity Latest activity:

2&2 Slider To Leyritz

Well-known member

I've read the article 923 cited three times and I can't figure out what in the world you're talking about 2&2. The point of the article is to examine donations to universities through a lens of tax expenditures and ways to fix the existing system. Now what you're talking about, I don't know or how it relates to the article at all. I think you're attacking the methodology but I can't figure out what exactly it is you have an issue with.

The whole underlying premise of the article is flawed. The premise, as set forth in its sensationalist headline is that private schools "get ten times as much tax money per student as public colleges", and then goes on to suggest ways to fix the system, under the assumption that it is broken. Neither Princeton or any other school "get ten times as much tax money". Where are they getting "tax money" from? Where are the checks from the US Treasury? That is complete bullshit. What it should say, if it were being honest, is that "private schools benefit from tax deductions able to be claimed by their donors, as said deductions may, to some unknown degree, cause said donors to donate more than they otherwise would donate without said tax deduction, but we have no real data to back that up, only as to the amount actually given, so we just make assumptions from that point".

And furthermore, why is this a problem? So Princeton and Harvard turn out smart people who make money who then give back to Princeton and Harvard? Why does that need "fixing"? Isn't that the point, both for them and for the Country? Don't we want to generate smart philanthropic people, and encourage that? If Michael Jordan wants to give $30 million to UNC, I don't think anybody is stopping him, and we should encourage that as well. If he doesn't want to do that, then that is his decision. It isn't like there aren't plenty of successful people from public colleges.

ONW

Well-known member

- Joined

- Apr 19, 2011

- Messages

- 19,177

- Reaction score

- 658

I ran a private equity portfolio that handled commercial real estate investments for endowments, non-profits, and "investors" along the East Coast for three years.

"Giving money back to a university" isn't always a "donation."

Those tax deduction/donation numbers will never be made public if it's a private entity (the donor and the institution), so I'm not sure where that 10X number comes from.

Agreed it is a win/win situation for everyone involved except the IRS (which isn't necessarily a bad or deceptive practice), and ultimately (possibly decades later) they get their cut as well no doubt.

"Giving money back to a university" isn't always a "donation."

Those tax deduction/donation numbers will never be made public if it's a private entity (the donor and the institution), so I'm not sure where that 10X number comes from.

Agreed it is a win/win situation for everyone involved except the IRS (which isn't necessarily a bad or deceptive practice), and ultimately (possibly decades later) they get their cut as well no doubt.

Last edited:

Deacon923

Scooter Banks

Let's back up for a second.

This is an income inequality thread. For the last few centuries, the best way to move up from poverty is to get an education. Conversely, if elites want to maintain their position atop the income distribution ladder, the best way to do so is to make sure the top institutions of education are dominated by the existing elites and their children.

As a country, we say we value education, and we say we want poor and middle class kids to get educated so they can move up.

If this is the case, we should expect that our government expenditures should be directed at supporting that policy.

In fact, we find (to no one's surprise) that government expenditures are instead greatly weighted toward supporting the elite private institutions that overwhelmingly serve the children of existing elites. How do we know that? We compare the two. Granted, the article uses estimates, but I think an honest reader of the article would agree that these estimates are not unreasonable.

Princeton vs. College of New Jersey, 2010.

Princeton's tax breaks on its endowment earnings (this is direct money to the bottom line): $151 million in untaxed ordinary gains, $94 million in untaxed capital gains.

The College of New Jersey barely has an endowment.

Princeton received $250 million in research grants. The article does not count the entire amount of the grant, just the approximately $75 million that goes to the school's general fund to cover "overhead". PH and other academics here can tell you how important those overhead dollars are.

Let's leave out the tax expenditures on donations for a moment. The total so far is $320 million in one year in taxpayer subsidies to Princeton University. That's over $41,000 per student.

The state college down the road gets less than $2,000 per student from government sources, according to the article.

For comparison in NC, our flagship state university in 2012 received 486,492,000 in direct state support as well as $578,702,000 in federal grants; using the overhead estimate in the article, 30% of that would be $173,610,000. Add in $181,339 of non-capital grants, most of which is likely Federal financial aid. I don't have time to delve into the full analysis on Carolina's tax exempt endowment earnings and donations. For a partial picture, then, Carolina received at least $841,441,000 in government support, divided by 29,278 students that year for government funding per student of at least $28,739 (underestimate due to excluding the tax-free endowment and investment gains, which for Carolina would be a significant number though far less than Princeton).

So this per student number is substantially less than Princeton, but a lot better than the State College of New Jersey (for which all North Carolinians should be thankful).

Now one could argue that Carolina is itself an elite school that isn't exactly in the business of raising up the poor and middle class. So I looked at my parents' alma mater, Appalachian State, which has for decades served the mission of getting some education into the hinterlands of Western NC. Here's the 2010 financial report.

If I am reading this right, I think the following line items are essentially government-funded: State Appropriations, State Aid-Federal Recovery Funds, and Noncapital Grants - Student Financial Aid (i.e., Pell grants), and Capital Grants. Those line items total $183,713,095. Investment income was $2,848,096; it's hard to estimate what portion of that represents taxes a for-profit would have paid but clearly it's a small amount in comparison to Princeton's enormous endowment. Let's just round up a little and say ASU received around $185,000,000 in total government support. ASU had probably around 17,000 students in 2010 for a total per student government support of $10,800. Still better than the State College of New Jersey, but less than 40% of UNC Chapel Hill and less than a quarter of Princeton's support.

I am betting that a school like UNC-Pembroke or Western Carolina would show even lower numbers.

What we can see from this exercise is colleges/universities that are actually in the business of educating the poor and middle class receive far less government support, without even counting tax expenditures on donations, than colleges/universities that are in the business of keeping elites elite. A chunk of this comes from research grants, which at least produce good things for society; a much larger chunk comes from exempting these huge endowments from taxation.

This is an income inequality thread. For the last few centuries, the best way to move up from poverty is to get an education. Conversely, if elites want to maintain their position atop the income distribution ladder, the best way to do so is to make sure the top institutions of education are dominated by the existing elites and their children.

As a country, we say we value education, and we say we want poor and middle class kids to get educated so they can move up.

If this is the case, we should expect that our government expenditures should be directed at supporting that policy.

In fact, we find (to no one's surprise) that government expenditures are instead greatly weighted toward supporting the elite private institutions that overwhelmingly serve the children of existing elites. How do we know that? We compare the two. Granted, the article uses estimates, but I think an honest reader of the article would agree that these estimates are not unreasonable.

Princeton vs. College of New Jersey, 2010.

Princeton's tax breaks on its endowment earnings (this is direct money to the bottom line): $151 million in untaxed ordinary gains, $94 million in untaxed capital gains.

The College of New Jersey barely has an endowment.

Princeton received $250 million in research grants. The article does not count the entire amount of the grant, just the approximately $75 million that goes to the school's general fund to cover "overhead". PH and other academics here can tell you how important those overhead dollars are.

Let's leave out the tax expenditures on donations for a moment. The total so far is $320 million in one year in taxpayer subsidies to Princeton University. That's over $41,000 per student.

The state college down the road gets less than $2,000 per student from government sources, according to the article.

For comparison in NC, our flagship state university in 2012 received 486,492,000 in direct state support as well as $578,702,000 in federal grants; using the overhead estimate in the article, 30% of that would be $173,610,000. Add in $181,339 of non-capital grants, most of which is likely Federal financial aid. I don't have time to delve into the full analysis on Carolina's tax exempt endowment earnings and donations. For a partial picture, then, Carolina received at least $841,441,000 in government support, divided by 29,278 students that year for government funding per student of at least $28,739 (underestimate due to excluding the tax-free endowment and investment gains, which for Carolina would be a significant number though far less than Princeton).

So this per student number is substantially less than Princeton, but a lot better than the State College of New Jersey (for which all North Carolinians should be thankful).

Now one could argue that Carolina is itself an elite school that isn't exactly in the business of raising up the poor and middle class. So I looked at my parents' alma mater, Appalachian State, which has for decades served the mission of getting some education into the hinterlands of Western NC. Here's the 2010 financial report.

If I am reading this right, I think the following line items are essentially government-funded: State Appropriations, State Aid-Federal Recovery Funds, and Noncapital Grants - Student Financial Aid (i.e., Pell grants), and Capital Grants. Those line items total $183,713,095. Investment income was $2,848,096; it's hard to estimate what portion of that represents taxes a for-profit would have paid but clearly it's a small amount in comparison to Princeton's enormous endowment. Let's just round up a little and say ASU received around $185,000,000 in total government support. ASU had probably around 17,000 students in 2010 for a total per student government support of $10,800. Still better than the State College of New Jersey, but less than 40% of UNC Chapel Hill and less than a quarter of Princeton's support.

I am betting that a school like UNC-Pembroke or Western Carolina would show even lower numbers.

What we can see from this exercise is colleges/universities that are actually in the business of educating the poor and middle class receive far less government support, without even counting tax expenditures on donations, than colleges/universities that are in the business of keeping elites elite. A chunk of this comes from research grants, which at least produce good things for society; a much larger chunk comes from exempting these huge endowments from taxation.

ImTheCaptain

I disagree with you

did i just see that SS benefits will be rising in 2015? thanks, boomers

2&2 Slider To Leyritz

Well-known member

What we can see from this exercise is colleges/universities that are actually in the business of educating the poor and middle class receive far less government support, without even counting tax expenditures on donations, than colleges/universities that are in the business of keeping elites elite. A chunk of this comes from research grants, which at least produce good things for society; a much larger chunk comes from exempting these huge endowments from taxation.

I didn't realize that Princeton only educated rich kids. Wait a minute, they don't.

"At Princeton, the tuition rate may be close to $40,000, but the average student is paying a "net price" closer to $12,000 or $13,000 once grants and scholarships are factored in, Behr said. Princeton is able to offer generous financial aid packages thanks to its $17 billion endowment, one of the largest in the nation."

http://www.nj.com/news/index.ssf/2013/01/princeton_tuition_tops_40000_t.html

Furthermore, the child of a family making less than $80,000 gets an average grant of $47,350, which is MORE than the aggregate tution, room, and board $47,020. If someone is not going to Princeton, it is not because they can't pay for it.

http://www.princeton.edu/main/news/archive/S25/35/66Q48/index.xml

So the average student at Princeton is able to go there for less than an in-state student at Carolina. And why is that? Because of their endowment and donations.

I do not understand how you could possibly be complaining about this. You are the champion of underfunded education on this board. And here we have private individuals voluntarily giving massive sums of money towards educating our best and brightest, and you have a problem with that too. Isn't this what you want? It is voluntary wealth redistribution directly tied to educational performance. The school that is performing best gets the most money, and uses that money to educate anybody who can meet its academic qualifications, regardless of their financial resources. Why on earth does that need fixing? [And no, your taxes are not going to pay for that. Even under that ridiculous theory posed by the author of that article, taxes are not a zero-sum game under our actual system. One person taking a particular deduction has absolutely zero effect on what anyone else pays either relative to a rate or in real dollars.]

Deacon923

Scooter Banks

*snort*

From Princeton's own article:

I don't know how they calculate "low income". I note the lowest category in the sidebar is income under $60,000, so that may be what they mean by "low income". That's interesting in and of itself.

More to the point, of the 782 students receiving aid, almost 500 are not low income. What does that mean? It probably means this: http://education.newamerica.net/sites/newamerica.net/files/policydocs/Merit_Aid%20Final.pdf

Colleges of all stripes, including Princeton, now allocate more of their aid to "merit based" scholarships than need based. "Merit" can mean a really smart kid or a good flute player, and it can also mean the child of a wealthy CEO, an influential donor or a politician. Princeton, like all elite schools, does dole out some money to get a nice-looking percentage of poor kids on campus. Princeton should be commended for that. Princeton also doles out a lot of money in an arms race with other elite schools to attract the most sought-after students, most of whom are not low income.

BTW, check out the tables starting on page 5. Princeton is in the third group, a group of private schools which admit few low income students but at least don't charge them much. Wake Forest is in the unenviable fourth group, which admits few low income students and charges them a lot. Way to go, Wake.

Nobody is saying that Princeton is evil or that it is doing anything wrong here, as 2&2's last post seems to imply. I am simply following the money. The money spent by our government flows freely to colleges serving the economic elite, and much, much more stingily to colleges serving the least affluent.

To further my point, over 1/4 of Applachian State students receive federal Pell grants, vs. only 12% at Princeton (see report linked above).

From Princeton's own article:

A total of 782 incoming freshmen are receiving financial aid. The record-high number and percentage of students on aid are up substantially from the previous year's record of 697 students, or 56 percent of the class of 2012. The average grant of $35,309 is up from $33,671 a year earlier (see sidebar). The incoming class includes 206 students from low-income backgrounds, or nearly 16 percent of freshmen.

I don't know how they calculate "low income". I note the lowest category in the sidebar is income under $60,000, so that may be what they mean by "low income". That's interesting in and of itself.

More to the point, of the 782 students receiving aid, almost 500 are not low income. What does that mean? It probably means this: http://education.newamerica.net/sites/newamerica.net/files/policydocs/Merit_Aid%20Final.pdf

Colleges of all stripes, including Princeton, now allocate more of their aid to "merit based" scholarships than need based. "Merit" can mean a really smart kid or a good flute player, and it can also mean the child of a wealthy CEO, an influential donor or a politician. Princeton, like all elite schools, does dole out some money to get a nice-looking percentage of poor kids on campus. Princeton should be commended for that. Princeton also doles out a lot of money in an arms race with other elite schools to attract the most sought-after students, most of whom are not low income.

BTW, check out the tables starting on page 5. Princeton is in the third group, a group of private schools which admit few low income students but at least don't charge them much. Wake Forest is in the unenviable fourth group, which admits few low income students and charges them a lot. Way to go, Wake.

Nobody is saying that Princeton is evil or that it is doing anything wrong here, as 2&2's last post seems to imply. I am simply following the money. The money spent by our government flows freely to colleges serving the economic elite, and much, much more stingily to colleges serving the least affluent.

To further my point, over 1/4 of Applachian State students receive federal Pell grants, vs. only 12% at Princeton (see report linked above).

Last edited:

Deacon923

Scooter Banks

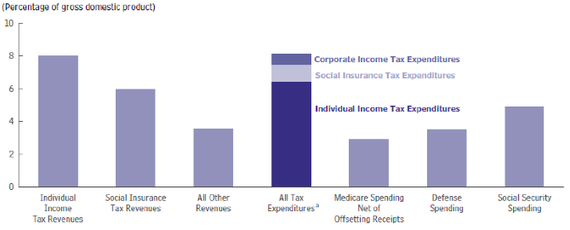

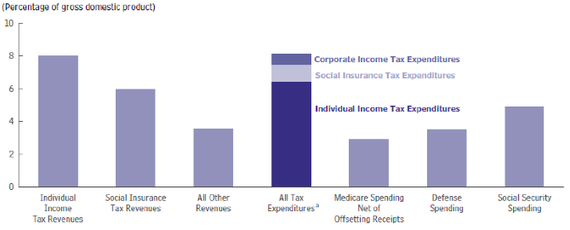

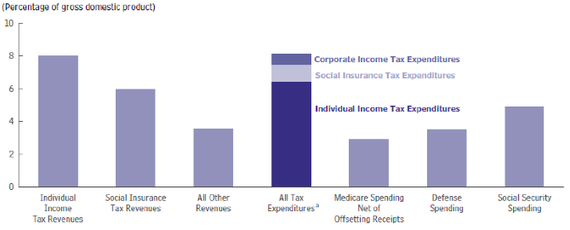

Some thoughts on tax expenditures, which apparently is actually the largest single component of the government, and which largely goes to benefit the wealthy. http://www.theatlantic.com/business/archive/2014/11/one-simple-trick-for-getting-somebody-to-approve-of-more-government-spending/382285/

The tax-expenditure budget unwinds some of the progressivity of the tax code. More than 50 percent of the benefits of tax expenditures go to the richest fifth of the population, thanks to tax breaks on investment income, savings, and mortgage interest. The richest fifth of the country sees almost all (93 percent) of the benefit of the tax break on capital gains, and the richest 1 percent enjoys two-thirds of that benefit.

Some thoughts on tax expenditures, which apparently is actually the largest single component of the government, and which largely goes to benefit the wealthy. http://www.theatlantic.com/business/archive/2014/11/one-simple-trick-for-getting-somebody-to-approve-of-more-government-spending/382285/

Tax expenditures = benefit the wealthy

in the same way that

decreases in ticket prices to baseball games primarily benefit baseball fans.

tjcmd

Retired

Baseball fans are not forced to attend games.

Deacfreak07

Ain't played nobody, PAWL!

Baseball fans are not forced to attend games.

WITH A GUN

ImTheCaptain

I disagree with you

lol

Wakeforest22890

Snowpom

Wakeforest22890

Snowpom

He's gotta yank on his non-existent bootstraps! I used to post articles like that to Facebook until the number of people commenting who didn't realize the onion was a satirical source reached a critical mass. It was a good way to figure out who to unfriend

WFFaithful

Well-known member

Wakeforest22890

Snowpom

ChrisL68

Riley Skinner

- Joined

- Mar 16, 2011

- Messages

- 31,182

- Reaction score

- 3,609

Not sure where else to put this, but Wal-Mart gets out of ~$1BN of taxes every year.

From paying US corporate rates on WW income maybe, but that doesn't even approach realism.

WakeandBake

Well-known member

Come on Townie, if the jackbooted guvernment wasnt stealing money from hard working americans with a gun, they would hand that money over to charities to feed the poor.