DeacsATS

Sam "Ace" Rothstein

TELL, motherfuckers.

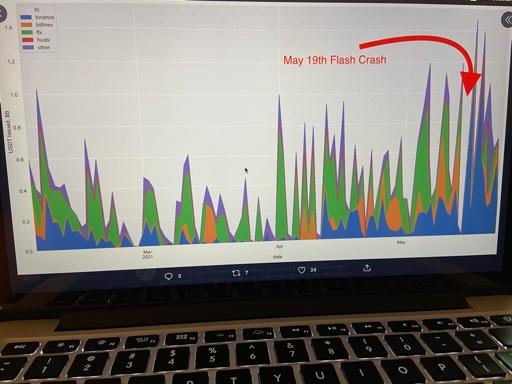

In reading the settlement agreement, there's nothing in there saying that NY agrees that Tether has adequate reserves. The settlement was for Tether to stop doing business with people from NY. There's absolutely nothing in this summary of facts linked below that gives any confidence whatsoever. They could literally just be printing tethers with no backing. Crypto currently appears to be a ponzi scheme. Which is the obvious result of unregulated markets being worth trillions. It works as long as people plow new money in...... Past 24 hours of volume of tether = volume of the other 9 top cryptos added together.

I've seen nothing that suggests other than that someone gives tether their bitcoin. then tether transfers their bitcoin in exchange for a related party IOU. Tether themselves says their reserves consist of related party receivables. there appears to be nothing stopping the related party to just stiff paying it back and walking away with everyone's bitcoin. It's a 10 person company with the banking history below that can't produce a financial statement and is completely unregulated. It's pure madness.

https://www.jdsupra.com/legalnews/t...ruary, the New,$850 million in customer funds.

You need to keep reading the entire agreement. And you need to know what Tether previously provided to the OAG. And, to be clear, they also have already made their first required disclosure about the status of their reserves as per the settlement agreement as of 3/31/21. Put it this way, this issue had a huge spotlight on it prior to the settlement being reached. And that spotlight remained on full force leading up to their first required disclosure about reserves under the settlement. There literally were some people claiming the principals of the company would just walk off. So there was a lot of focus on the required disclosure, which they met.

IIRC the breakdown as of 3/31/21 was Tether was backed 75% by cash and cash equivalents, about 15% by secured loans and about 10% with corporate bonds and precious metals deposits. They'll have to make another disclosure as of 6/30. And those disclosures will continue quarterly for two years.

Do you actually think the state of New York was going to walk through a massive investigation and then, in your words, just walk away without any protections for their citizens by permitting a "ponzi"? People and institutions in New York, after all, use Tether every single day and, more importantly. participate in crypto markets in large volumes. It absolutely was in the state's interest to track and monitor those reserves going forward, which is what they are doing.

FWIW, not that it would be much use if USDT was a complete scam, but I use USDC (fully reserved with USD) and LUSD (backed fully by ETH) when using stable coins.

I've read the actual disclosure. First off, it's not financial statements. Secondly, if you want to be legitimate, you have the big 4 issue an audit report. You don't get Moore Cayman to do it.

It can be found here

https://tether.to/wp-content/uploads/2021/04/tether-assurance-mar-2021-2.pdf

Tether’s First Reserve Breakdown Shows Token 49% Backed by Unspecified Commercial Paper

https://www.coindesk.com/tether-first-reserve-composition-report-usdt

I believe I read elsewhere, actual cash was 3%. When you say "75% is cash and cash equivalents" what they're counting is related party due to/froms. (See next post from Bloomberg) So basically at some point tether took the cash or crypto it received and transferred it to another entity. You sure that those other entities are gonna give those billions back if needed?

This is almost assuredly massive fraud, and it's supporting the entire crypto market.

I've read the actual disclosure. First off, it's not financial statements. Secondly, if you want to be legitimate, you have the big 4 issue an audit report. You don't get Moore Cayman to do it.

It can be found here

https://tether.to/wp-content/uploads/2021/04/tether-assurance-mar-2021-2.pdf

Tether’s First Reserve Breakdown Shows Token 49% Backed by Unspecified Commercial Paper

https://www.coindesk.com/tether-first-reserve-composition-report-usdt

I believe I read elsewhere, actual cash was 3%. When you say "75% is cash and cash equivalents" what they're counting is related party due to/froms. (See next post from Bloomberg) So basically at some point tether took the cash or crypto it received and transferred it to another entity. You sure that those other entities are gonna give those billions back if needed?

This is almost assuredly massive fraud, and it's supporting the entire crypto market.

And you think the State of New York didn't pass through the disclosure. Again, what did Tether provide the state to obtain its settlement? You do not know. Neither do I. Would they have gotten such an easy settlement if it was bogus? I guess you say yes. I say unlikely.

It also states that it records the "commercial paper" at cost. Meaning if it lent money to someone that can't pay you back, it's still recorded as if you'll get it all back. Read the full allegations from NYC, they're comically criminal, and now they're 30x larger.

What more can NY do to them other than fine them and bar them from doing business in the state?

They have not barred them from doing business in the state. There are exclusions to that bar. And they can criminally prosecute any individual participating in a fraud in the state. You are reaching conclusions. That's fine. I'm looking at the fact the state is monitoring the situation based upon documentation provided to the state in the investigation that neither you nor I have access to. You're determining the state did a shitty job confirming the nature of the reserves during the investigation and is continuing to do a shitty job monitoring the settlement. I'm not reaching that conclusion. But hey, I will say this. I don't hold USDT.

In February 2021, Bitfinix agreed to pay $18.5 million in a settlement with the New York Attorney General's office regarding allegations over Bitfinex parent iFinex making false statements about the backing of Tether and the movement of hundreds of millions of dollars between the two companies to cover up massive losses by Bitfinex in 2017 and 2018. As part of the agreement, Bitfinix will end all trading activity with New Yorkers.[26]

What do you mean there are exclusions to the bar? From everywhere I read:

Aren't you an accountant by trade, btw?

Again, the settlement agreement does not ban all activity in New York. It's literally in the agreement. Read it. Trading activity for Bitfinix is stopped. But other activities are still ongoing. And Bitfinix has a host of other problems.

Further, some of the people cited in your source Mish document are known scams. Zeus Capital. Good grief. I don't even know where to start with that one. They shorted Chainlink and tried to spread all sorts of doubt in an effort to avoid getting liquidated. Here's but one discussion on the topic as it was a big story last summer when LINK was trading at like $9 (now at around $30). https://smartcontentpublication.med...isinformation-report-on-chainlink-7313d9e1801 "Mr. Whale" who that article cites is also allegedly someone who has defrauded various people with schemes over the years.

At the end of the day you essentially are saying the State of New York is completely out to lunch and is now basically participating, in an ongoing manner, in a massive fraud against its own residents (both people and corporations). Maybe they're that incompetent. Maybe they aren't. I certainly don't have 100% proof they aren't. I'm also not going to conclude, as you've been doing, that they are.

Crypto definitely has its share of bullshit. I get it. Wash trading. Exchanges in all corners of the world, including places that have lax or no regulatory oversight. Rug pulls. Interactions with smart contracts that if not properly constructed could be hacked. There's definitely plenty of shit to worry about. So when the state of New York runs a full on investigation and requires ongoing monitoring, I actually view that as a good thing. And I don't leap to the conclusion, which is essentially what you are doing, that the state didn't and won't do it's job.

An agreement with iFinex, Tether, and their related entities will require them to cease any further trading activity with New Yorkers, as well as force the companies to pay $18.5 million in penalties, in addition to requiring a number of steps to increase transparency.

I don't claim to be an expert on this stuff, but I've read the agreement a few times. It's linked here. And here's a quote.

https://ag.ny.gov/press-release/202...l-currency-trading-platform-bitfinexs-illegal

What is it that's allowed that's giving you confidence in it, and what is it that's "banned" vs you seem to indicate is "allowed and still happening?"

Again, I ask, why would anyone buy or need tether? I've sent money into coinbase, you buy crypto with that, if you want to sell the crypto you sell the crypto and it gives you dollars, and if you want to buy another crypto you use those dollars to buy other cryptos.

What does tether provide OTHER than fraud to the point where it's volume is higher than all the rest of the top 10 cryptos together? Seems like someone prints tether, uses tether to buy dogecoin and other altshit, and the altshit goes up 1000's of percent because people think tether is backed by dollars.

I have no confidence in Bitfinex. I've never dealt with them in any way. So I have no basis to feel good about them. I'm merely noting that you are not reading the entire agreement as it makes clear the company still conducts other activities in New York state. Because I've read it too.

Is it better for any stable coin to be fully backed by USD. Yes. That's why I use USDC primarily. I do find it interesting, however, that the OCC is saying Federally regulated banks are going to be allowed to use stablecoins like USDT for payments and services. On what basis are they confident pegs won't get broken?