sailordeac

Well-known member

Including capital gains income to individuals, IMO.

Agree: all individual income, earned or investment.

Including capital gains income to individuals, IMO.

Agree: all individual income, earned or investment.

Sure, why not. We're redesigning the program. At this point and into the future, unlike most of the 20th century, capital is eating and will continue to eat up a greater and greater share of the income in the country, and labor will receive a lesser and lesser share. Further, private companies used to voluntarily fund their workers' retirements, now they try to avoid it at all costs and shift all risk and responsibility to the worker. Subjecting capital gains to SS tax is a simple way of recognizing those changed dynamics and accessing some of the income flowing to capital to support laborers in their old age.

BUT THAT MONEY'S ALREADY BEEN TAXED !

Keep Social Security. Uncap the earnings tax limit, but keep the limit for benefit calculations. Social Security will be solvent and the additional means testing will only hurt those who can afford it. I'd also increase the earnings penalty modestly for early retirees, but make 100% of SS benefits subject to FIT for higher income retirees.

TITCR, at least the first part, which is quite similar to Bernie Sander's proposal. His difference is that, after the taxable wage base is hit, that earnings > 250k is subject to the payroll tax. The chief actuary of the SS says this will keep the program solvent for the next 75 years.

That is a bullshit plan, that just takes more money from middle class W-2 workers, who are mostly saving for themselves, to redistribute to those that don't. So they end up saving for themselves and everyone else. You'd end up soaking the 40-90%, who should be the ones we are trying to encourage to focus on self-sufficient retirement to get them away from SS. If the goal is to income shift from the high net worth people to the lowest, then de-couple SS from W-2 earnings altogether and fund it solely from capital gains, and then means test the benefits.

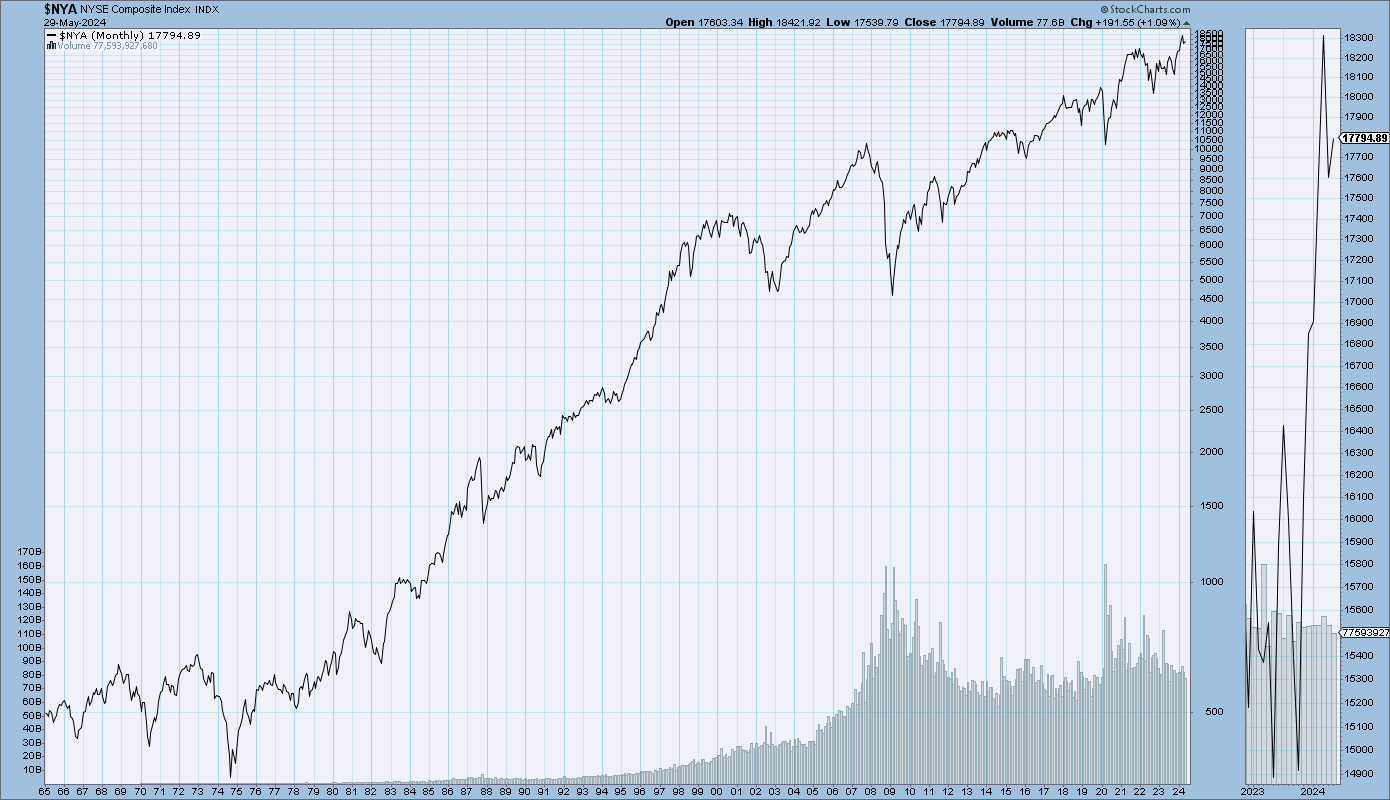

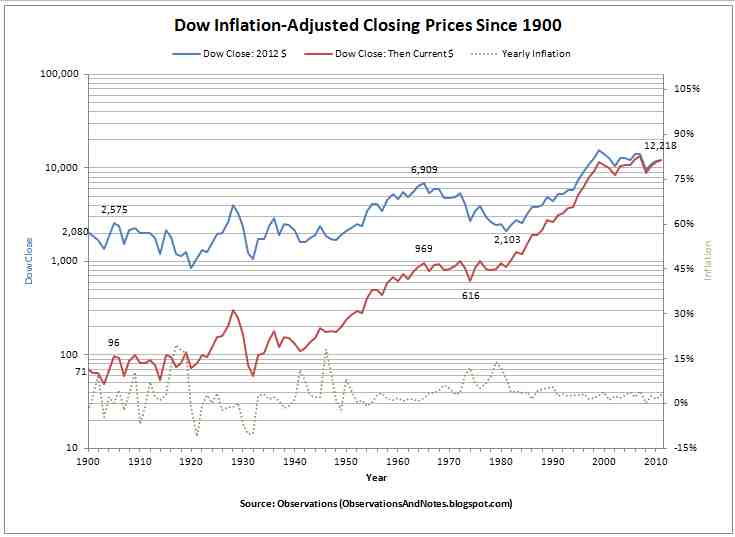

So what difference would it make that the stock market always preformed well over 15 and 40-year timelines if the next Black Tuesday occurs right when I'm hitting retirement age and I haven't properly allocated into bonds of companies that aren't also going to be taken down by the crash?

That's a stock market that doesn't contain billions of SS money. Does that make the market more or less volatile over time?

Just for clarification, are you saying 40-90% of people paying into SS earn > $250k and that >250k is "middle class?" That may be true in certain zip codes, but not for 99.999% of the rest of the US. That 250k is an annual amount, in case that needs to be specified. If so can you show me a source verifying that percentage? I was unable to find such verification.