GOP tax plan: 5 ways the proposed tax cuts could impact you

Quote

————

...Called the Tax Cuts and Jobs Act, the tax reform proposal is billed by Republican lawmakers as a path to job creation and higher wages for workers, even though there's little historical evidence that corporate tax cuts trickle down into higher pay for employees. Nevertheless, some low-wage and middle-class Americans are likely to benefit, thanks to a higher personal standard deduction and lower tax rates, although many may end up with fewer deductions, especially those in high-tax states. Middle-class gains may be scanty compared with those enjoyed by corporations and the wealthy, critics said.

"There is no evidence to suggest this plan as a whole will be positive for middle-income workers and much to suggest that when this is complete, it will be a significant net negative," said Gene Sperling, a former director of the National Economic Council and Assistant to the President for Economic Policy in The White House, on a conference call to discuss the tax plan. "You can lower somebody's taxes, but people understand there is no free lunch."

The tax cuts are unlikely to be offset by equivalent spending reductions, which could cause the federal budget deficit and debt to grow, Moody's Investors Service senior vice president Sarah Carlson said by email.

"It is unlikely that the increased taxable income from higher growth will compensate for the proposed cuts in tax rates," she added.

Many of the provisions in the proposal will help President Donald Trump's businesses and boost his personal income, said Seth Hanlon, a senior fellow at the liberal-leaning Center for American Progress. Those include the phase out of the estate tax and lower rates for pass-through income.

"It's almost as if this bill was written by Donald Trump's accountant," Hanlon said.

Like any major piece of legislation, the House GOP tax plan is likely to change as lawmakers wrangle over the details and as special interests weigh in. Passage of the bill is not assured, even with Republicans controlling both chambers of Congress and as Mr. Trump pushes legislators to deliver a measure by year's end. For now, the proposal amounts to the biggest change in U.S. tax law in decades. Here are five key takeaways:

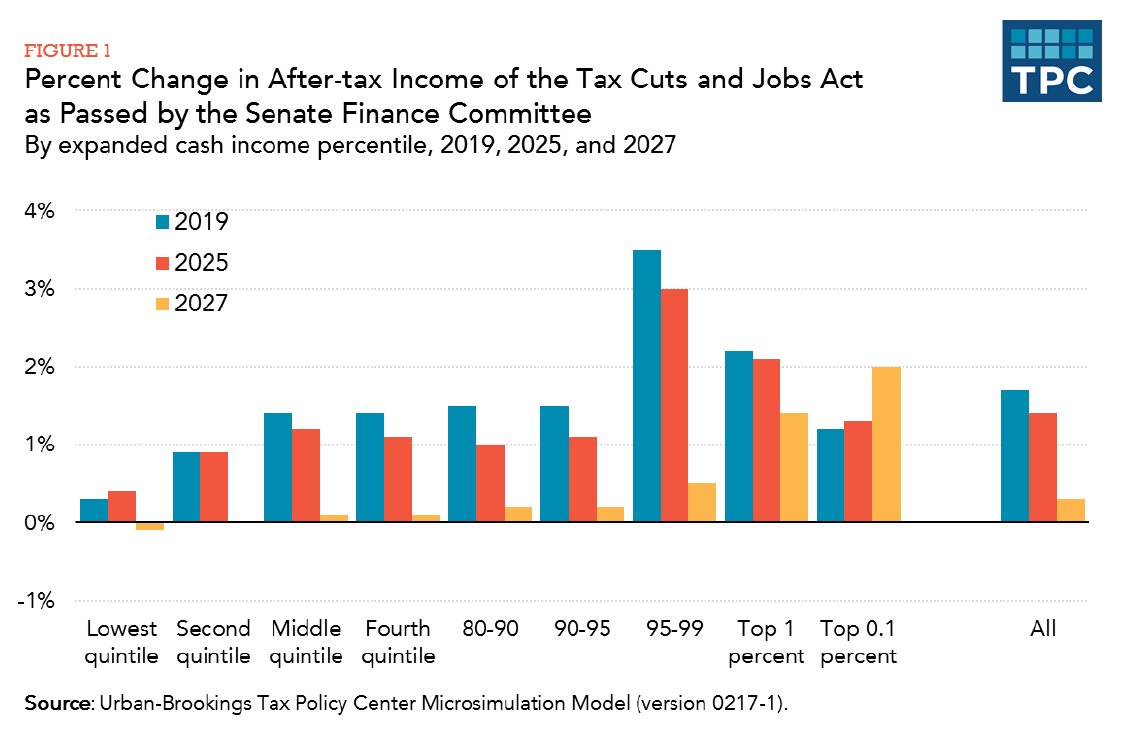

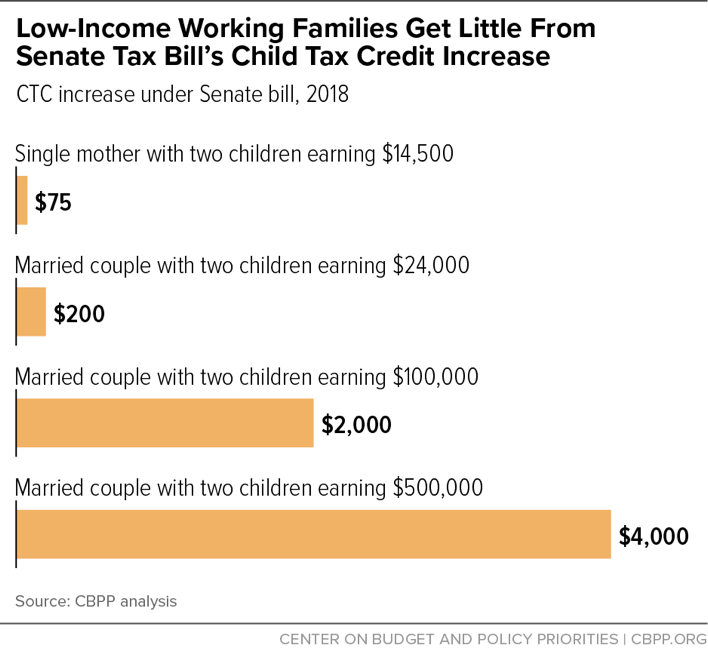

Who benefits most? The tax plan is billed by the GOP as providing a break to the middle class, but critics say the benefits will overwhelmingly be enjoyed by corporations and the rich. That's because the tax rate on corporations will be reduced to 20 percent from 35 percent, allowing the country's biggest companies to retain more of their profits.

Economists say there's little relationship between post-tax profit rates and business investment that boosts productivity, while productivity and wages have grown faster in periods of higher taxes, according to the left-leaning Economic Policy Institute.

How would the richest Americans fare under the bill? The GOP plan keeps the highest individual income tax bracket for the country's top earners at 39.6 percent. But critics say the proposal still provides a windfall to rich families because it will double the limit on the estate tax to $10 million and then phase it out after six years.

The proposal also calls for a 25 percent rate for pass-through businesses, such as sole proprietorships and partnerships, rather than paying the individual tax rate. For the rich -- who are more likely than the middle class to employ such tax structures -- that could produce a sizable savings.

The proposal also does away with the alternative minimum tax, which will help reduce taxes on some higher-income taxpayers...

————