deacs1995

i gave at the office

- Joined

- Mar 20, 2011

- Messages

- 8,592

- Reaction score

- 145

Let's say for a minute that Warren steps in to run against Hillary and in fact wins the nomination. How would she play in the rest of the country? Would CO, NM, VA, OH, WI, FL still go for a Democrat that wasn't Hillary?

Also no candidate has made a hard push against income inequality. Not sure how an anti-Wall Street campaign would work with poor whites people who tend to vote Republican.

Also the distribution of resources toward Wall Street and investors and away from American workers is a huge source of income inequality.

So how is that going to be handled? It can't just be bust up wall street. How is that money going to find its way back to main street? Divided equally? To each according to his need?

So how is that going to be handled? It can't just be bust up wall street. How is that money going to find its way back to main street? Divided equally? To each according to his need?

Also the distribution of resources toward Wall Street and investors and away from American workers is a huge source of income inequality.

In what way?

Not sure I understand your question. If people are investing in financial products managed by the pencil pushers instead of creating jobs or increasing wages, that contributes to income inequality.

The banking system underwrites that process through financial intermediation. In fact, that's a much more effective way of creating jobs, because financial institutions are more adept at identifying potentially successful entrepreneurs.

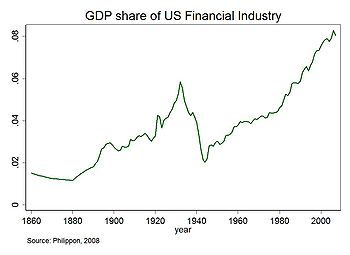

Any hypothesis as to why the depression caused a steep two decade decline while the 2008 recession didn't even hardly slow down the growth?

The banking system underwrites that process through financial intermediation. In fact, that's a much more effective way of creating jobs, because financial institutions are more adept at identifying potentially successful entrepreneurs.

The banking system underwrites that process through financial intermediation. In fact, that's a much more effective way of creating jobs, because financial institutions are more adept at identifying potentially successful entrepreneurs.