TR1982

Well-known member

- Joined

- Mar 16, 2011

- Messages

- 3,244

- Reaction score

- 156

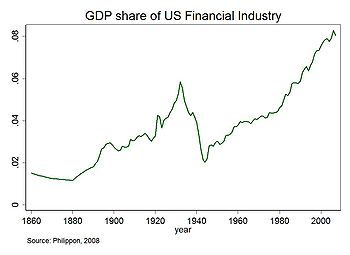

That's a nice story, but the last 30 years indicates it's just not true. The financial system we have in this country is mainly adept at wringing cost out of companies and returning the proceeds to investors. The result is effectively disinvestment in American workers and the American economy, in favor of investment in cheaper workers and cheaper materials elsewhere. The financial industry serves itself and the investor class. A efficient financial sector is good, don't get me wrong, but the amount of GDP being hoovered up by the financial sector in 2015 is extremely disproportional to the good it does for the broader economy.

http://www.pbs.org/newshour/making-sense/biggest-scam-bankrupting-business-middle-class/?utm_content=buffer7aab1&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

http://tcf.org/blog/detail/graph-how-the-financial-sector-consumed-americas-economic-growth

We're not even talking about the same thing. You're talking about reinvestment (or lack thereof) of retained earnings, which is in no way limited to the financial sector. I'm talking about financial intermediation, which is the process by which savings are pooled in depository institutions and then reinvested. Basically, the fundamental function of the banking system. To suggest that this doesn't occur is just plain wrong. Banks would not be able to turn a profit if it didn't.

As for the lack of reinvestment of earnings, this is something that has been occurring primarily since the crash, although it has gotten somewhat better recently. First of all, it was understandable (and prudent) to cut costs and invest in safe liquid assets in the uncertain (to put it mildly) investment and regulatory environment after the financial crisis. Second, cost cutting and efficiency increases are net positives for the economy, as they result in lower consumer prices. Investment is extremely important and a primary driver of long-term growth, but it would have been extremely negligent to spend a large amount of earnings on investing in durables et al after the crash with such weak overall demand in the economy. One quick downturn and your firm is insolvent.

And with regard to foreign investment, I'm assuming you are talking primarily about multinational corporations. Yes, this does occur, but it's laughable to suggest that there has been a lack of investment in the United States over the past thirty years. A quick glance at our large historical capital account surplus would put that contention to rest.