Is there anything worse? Every time I'm forced to deal with credit reports or whatever it reminds me of what a racket it is. Working through the mortgage process, I've had to write a letter to explain why I didn't pay my student loans straight out of school when the economy was in the shitter, and I couldn't get a job outside of waiting tables. They wanted me to explain a credit card I'd never had, and try to pay it (all $90 of it). Yet when I called the credit card company they assured me they didn't have any accounts for me (after 30 minutes trying to get a live person). I finally had to conference in the credit report bureau with the credit card company. SO now it is removed, but apparently will have no impact on my credit!?!?!?!

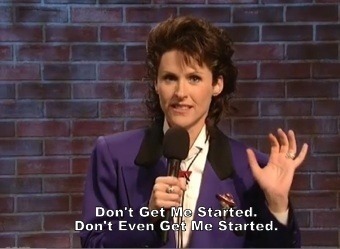

Don't even get me started on what you have to do improve your credit. Paying cash for a car and condo is a bad thing!?!?! not carrying a balance on my credit card is bad!?!?! canceling a credit card after the first free year for a better one is bad!?!?!?! such a racket.

Don't even get me started on what you have to do improve your credit. Paying cash for a car and condo is a bad thing!?!?! not carrying a balance on my credit card is bad!?!?! canceling a credit card after the first free year for a better one is bad!?!?!?! such a racket.