TownieDeac

words are futile devices

- Joined

- Mar 16, 2011

- Messages

- 76,189

- Reaction score

- 16,923

I was kinda hoping we could talk about the decriminalization or legalization of drugs.

Chris Christie is on the wrong side of this game, and has been a real hypocrite about it since he started to consider running for President - http://www.ibtimes.com/chris-christ...a-unlike-rand-paul-his-2016-gop-rival-1639408

Rand Paul gets it, though.

"See if you want to live in a major city in Colorado, where there are head shops popping up on every corner, and people flying into your airport just to get high. To me, it's not the quality of life we want to have here in the state of New Jersey," he declared.

It was a ~$400MM industry in Colorado last year just in medical. Recreational data is still forthcoming.

In states with high sales taxes, this could be an absolute monster of an injection to the coffers.

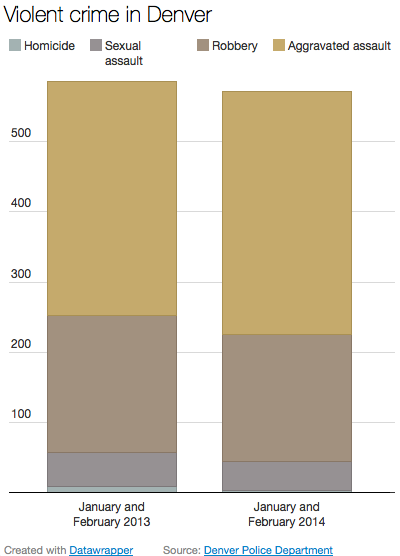

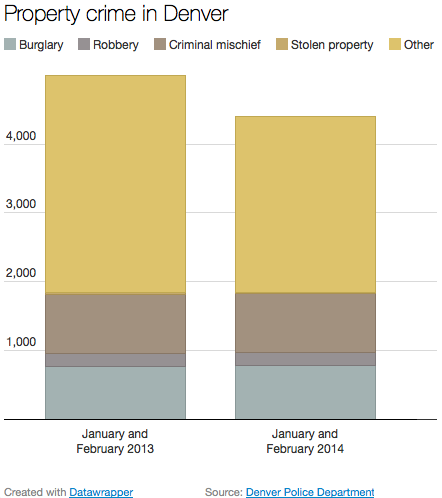

Not to mention essentially every single crime category has plummeted in Denver since legalization.

To recap: you work enough to earn $223,000, but you pay $83,291.5 to federal, state and local government not counting various sales taxes. You have $139,700 you and your wife can fight about. BTW, of the $16,320 you pay to the state, something like $1500-1600 goes to UNC.

People fly (well, they used to...) to your shitty ass state just to gamble.

It was a ~$400MM industry in Colorado last year just in medical. Recreational data is still forthcoming.

In states with high sales taxes, this could be an absolute monster of an injection to the coffers.

Not to mention essentially every single crime category has plummeted in Denver since legalization.

is there a link for the crime claim? very interested in that. makes sense though.

I didn't say it was impossible. I just take issue with the statement that small business owners, as a class, are paying over 35% effective rates. It's simply not true. Some may, but I would wager that the great majority are not. I mean, something like 80% of small businesses clear less than $50K/year.

However, in the six months that marijuana has been legal, the Denver Police Department has reported a significant reduction in crime. According to police statistics comparing crime rates from the first six months of 2013, the city has seen a 3 percent overall drop in violent crimes. That includes a 38 percent drop in homicides and a 19 percent drop in sexual assaults. Additionally, the data show an 11 percent decline in property crimes during the same time.

Though both law enforcement officials and drug law reformers say it is too soon to attribute those crime reductions to marijuana legalization, the data are consistent with a March 2014 study by University of Texas researchers showing no connection between looser marijuana laws and crime increases. Analyzing crime data from 11 states that had legalized medicinal marijuana, they found "no evidence of increases" in violent crimes after the new drug laws had passed. In fact, the researchers found that the total number of violent crimes was lower for states legalizing medicinal marijuana, which they said suggests legalization "may have a crime-reducing effect."

If you are a couple living in NC with grown children and both people work but your house is paid off or you rent you together might make a middle class taxable income of, say, $223,000. Federal taxes would be $49,912 (22.4%), SS and Medicare (not counting employer contribution) would be $17,059 (7.65%) and state income taxes would be $16,320 (7.31%). So you have given state and feds 37.5% of your income before you pay a lot more in sales taxes, gas taxes, etc. Also, you might have to pay real estate taxes. If you "own" a mid priced home in Chapel Hill, for instance you might have to pay $9,000 or more, bringing your total loss to 41.4% before you get to spend some on yourself.

To recap: you work enough to earn $223,000, but you pay $83,291.5 to federal, state and local government not counting various sales taxes. You have $139,700 you and your wife can fight about. BTW, of the $16,320 you pay to the state, something like $1500-1600 goes to UNC.

It's also neuroprotective. That's likely the real reason why they are thinking about allowing its use. It might help mitigate the concussion/head trama problem.http://www.theatlantic.com/entertainment/archive/2014/09/the-nfl-embraces-marijuana-finally/380246/

This is a really good article on marijuana and the NFL, with some discussion of science on marijuana benefits. One doctor in the article thinks that marijuana is basically the perfect therapeutic drug for football players to manage pain and stress.

If you are a couple living in NC with grown children and both people work but your house is paid off or you rent you together might make a middle class taxable income of, say, $223,000. Federal taxes would be $49,912 (22.4%), SS and Medicare (not counting employer contribution) would be $17,059 (7.65%) and state income taxes would be $16,320 (7.31%). So you have given state and feds 37.5% of your income before you pay a lot more in sales taxes, gas taxes, etc. Also, you might have to pay real estate taxes. If you "own" a mid priced home in Chapel Hill, for instance you might have to pay $9,000 or more, bringing your total loss to 41.4% before you get to spend some on yourself.

To recap: you work enough to earn $223,000, but you pay $83,291.5 to federal, state and local government not counting various sales taxes. You have $139,700 you and your wife can fight about. BTW, of the $16,320 you pay to the state, something like $1500-1600 goes to UNC.