You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Capitalism

- Thread starter Kory

- Start date

- Latest activity Latest activity:

PhDeac

PM a mod to cement your internet status forever

- Joined

- Mar 16, 2011

- Messages

- 155,316

- Reaction score

- 22,321

Yea, just thinking how well my son is doing for having double majored in Econ & investment finance in the Darla Moore School of Business. But nice try asshole

Learnin’ from those professors on the dole?

DeaconSig

Well-known member

Somebody was lonley, drunk, and big mad Saturday night.Yea, just thinking how well my son is doing for having double majored in Econ & investment finance in the Darla Moore School of Business. But nice try asshole

WFFaithful

Well-known member

If you're happy and you know it, be afraidThe Libs here are poorer in happiness. The ‘Pubs are perfectly happy.

If you're happy and you know it, be afraid

If you're happy and you know it, be afraid of diversity

If you're happy and you know it, be afraid

if you're happy and you know it, be angry

If you're happy and you know it, be angry

If you're happy and you know it, be angry cause we said so

If you're happy and you know it, be angry

If you're happy and you know it, believe the lies

If you're happy and you know it, believe the lies

If you're happy and you know it, believe the lies to justify your beliefs

If you're happy and you know it, believe the lies

BarcaDeac

Well-known member

Think of all the radio presents he can affordYea, just thinking how well my son is doing for having double majored in Econ & investment finance in the Darla Moore School of Business. But nice try asshole

BeachBumDeac

Cheap Date

- Joined

- Mar 17, 2011

- Messages

- 27,618

- Reaction score

- 15,182

TheReff

Rod Griffin

- Joined

- May 15, 2011

- Messages

- 6,433

- Reaction score

- 565

Capitalism at its best: OSV—off shore vehicles drilling for oil & gas have begun their next leg up since going sideways since March. Really nice because oil is down 30% and won’t stay down. RIG has new contracts with a $518 mill backlog order thru 2026. $3 yearly low, now $8.55. TGS, an Argentinian nat gas provider has run from $6 to over $12 in a year with plenty of room to run. YPF has run from $4 to $14 and is an Argentinian oil & gas service company with plenty of room to run.

Other OSV providers could do great because of the politics of the day globally-they just aren’t building any more drilling ships yet we need oil & gas. So before 2030 we can’t see much more supply in these vehicles. Look at TDW, SMHI, MRM, ATLA, SIOFF (Oslo),

10 year bear market so watch out how long the bull market in this market can run. Just like the above stocks. Nat gas is one to watch out for as China has bought as many of the futures as possible. (What will Europe heat with this winter? Coal again?)

Other OSV providers could do great because of the politics of the day globally-they just aren’t building any more drilling ships yet we need oil & gas. So before 2030 we can’t see much more supply in these vehicles. Look at TDW, SMHI, MRM, ATLA, SIOFF (Oslo),

10 year bear market so watch out how long the bull market in this market can run. Just like the above stocks. Nat gas is one to watch out for as China has bought as many of the futures as possible. (What will Europe heat with this winter? Coal again?)

ImTheCaptain

I disagree with you

ImTheCaptain

I disagree with you

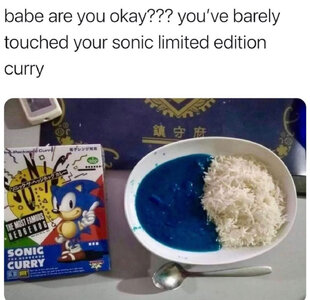

balanced breakfast not balanced dinner

BarcaDeac

Well-known member

“Save money by making me money”balanced breakfast not balanced dinner

ImTheCaptain

I disagree with you

Plus sugar!“Save money by making me money”

ImTheCaptain

I disagree with you

yeah, stop cereal shaming, Internet MobI like all kinds of breakfast for dinner, including cereal.