dartsndeacs

THE quintessential dwarf

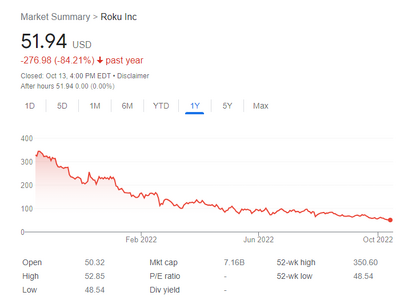

I took a loan out a little while ago so I could pounce on some volatility and woke up at 6AM this morning and saw the market down and was seriously considering pulling the trigger. Trying to find the time to buy some netflix/roku at a lower basis to counter some of my wife's trades. Of course missed the action today