Glad we’re getting into details. People are being housed at flat rates, sure.

Here are some other trends associated with that data (from NAR in 2022):

At just 26%, the share of first-time buyers was the lowest since NAR began tracking the data. The typical first-time buyer was 36 years old – an all-time high.

The median distance between the home that recent buyers purchased and the home from which they moved was 50 miles – a record high and more than a three-fold jump from a median of 15 miles from 2018 through 2021. The shares of homes purchased in small towns (29%) and rural areas (19%) were all-time highs.

The median expected home tenure for first-time buyers was 18 years, the highest ever recorded and up from 10 years in 2021.

——

And if you just take a break from the data, and look at the millennial cohort specifically, they graduated into a recession in prime earning years, and have hit another one since. During just the stretch of time when they could reasonably have expected to buy a home, interest rates have tripled while the cost of owning has increased. If they’re buying, they’re buying worse, smaller housing for more money than the cohort before them.

In the same time frame, boomers have doubled their wealth selling those more expensive houses and riding out interest rates into retirement. Last year they were a larger purchasing cohort than millennials, largely buying vacation or second homes financed with selling their older homes in desirable locations for many times what they paid.

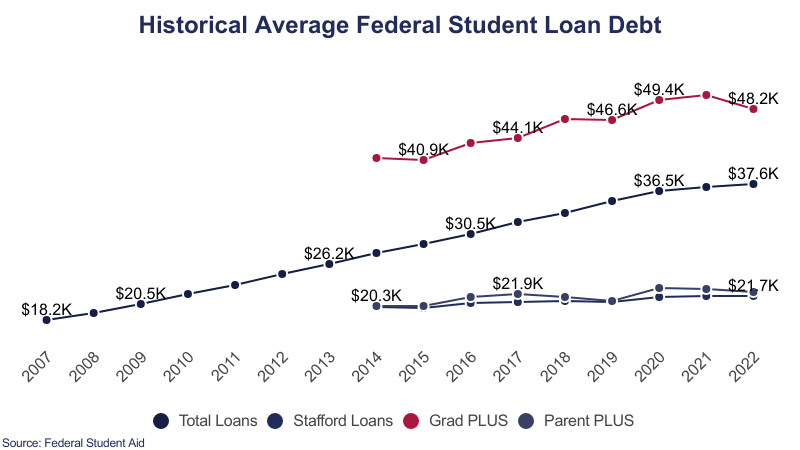

I’d argue that there are still more bubbles to do with debt facing millennials too, whether that will come in the form of housing or auto debt, pick your poison.